Ssa Form 795 Benefit Continuation Election Statement

Form SSA-795 (09-2015) ef (09-2015)

Destroy Prior Editions

Social Security Administration

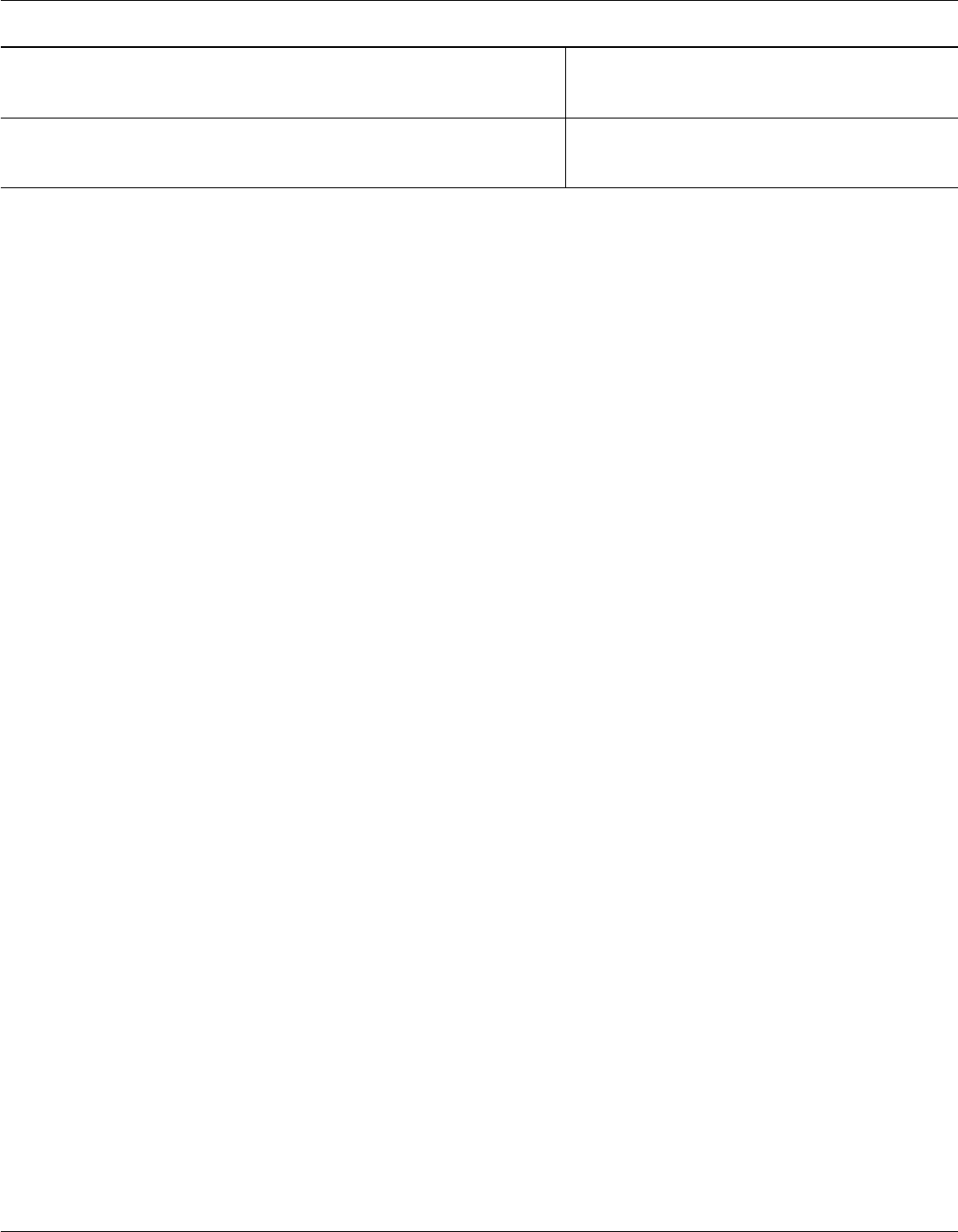

STATEMENT OF CLAIMANT OR OTHER PERSON

Form Approved

OMB No. 0960-0045

Name of Wage Earner, Self-employed Person, or SSI Claimant

Social Security Number

Name of Person Making Statement (If other than above wage earner,

self-employed person, or SSI claimant)

Relationship to Wage Earner, Self-Employed

Person, or SSI Claimant

Understanding that this statement is for the use of the Social Security Administration, I hereby certify that -

I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying

statements or forms, and it is true and correct to the best of my knowledge. I understand that anyone who knowingly

gives a false statement about a material fact in this information, or causes someone else to do so, commits a crime and

may be subject to a fine or imprisonment.

SIGNATURE OF PERSON MAKING STATEMENT

Signature (First name, middle initial, last name) (Write in ink) Date (Month, day, year)

Telephone Number (Include Area Code )

Mailing Address (Number and street, Apt. No.,P.O.Box, Rural Route)

City and State ZIP Code

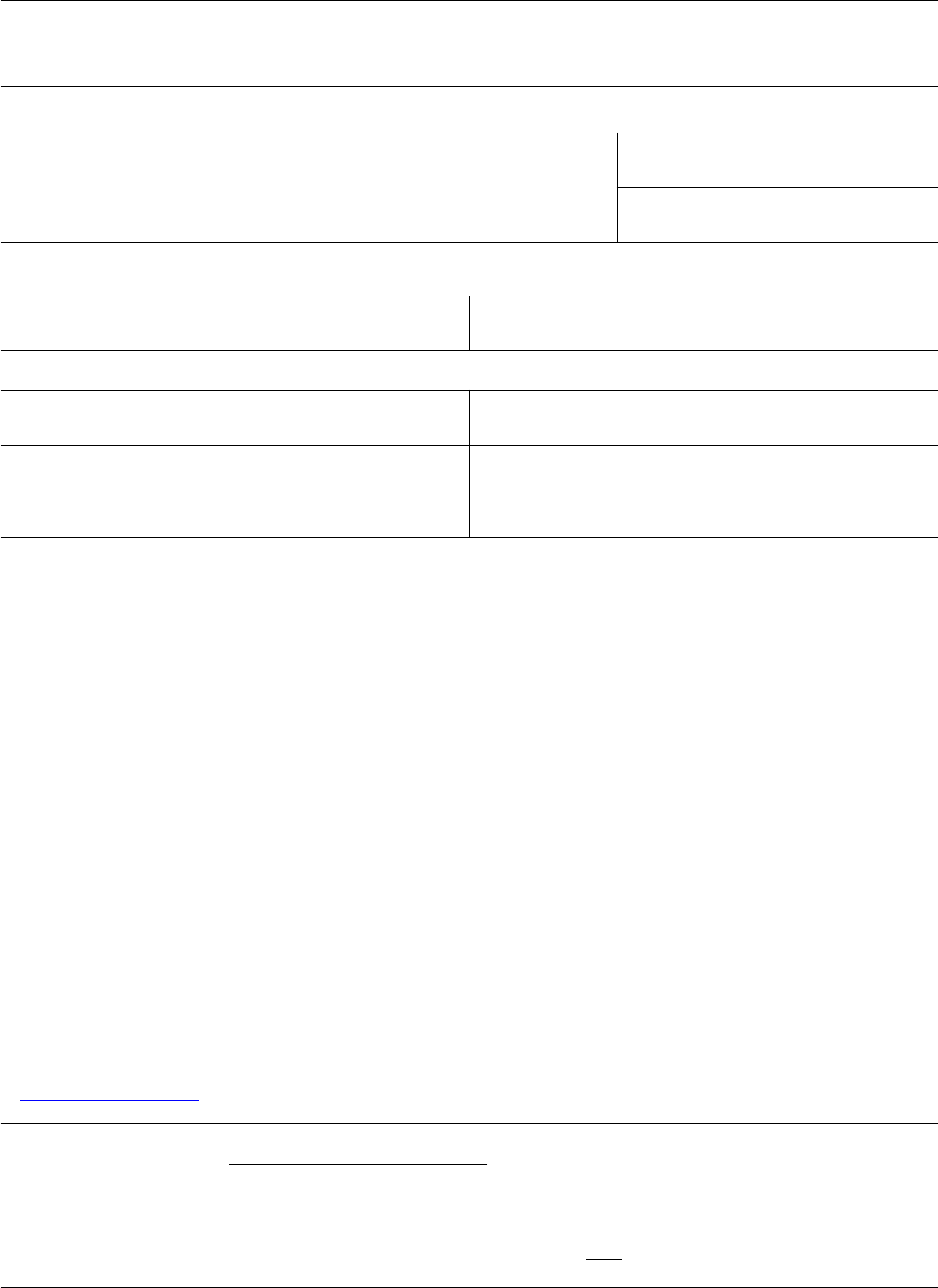

Witnesses are required ONLY if this statement has been signed by mark (X) above. If signed by mark (X), two witnesses

to the signing who know the individual must sign below, giving their full addresses.

1. Signature of Witness

Address (Number and street, City, State, and ZIP Code)

2. Signature of Witness

Address (Number and street, City, State, and ZIP Code)

Privacy Act Statement

Collection and Use of Personal Information

Section 205a of the Social Security Act (42 U.S.C. § 405a), as amended, authorizes us to collect the information on this

form. We will use this information to determine your potential eligibility for benefit payments.

Furnishing us this information is voluntary. However, failing to provide us with all or part of the requested information may

affect our ability to evaluate the decision on your claim.

We rarely use the information you provide for any purpose other than for determining entitlement to benefit payments.

However, we may use the information you give us for the administration and integrity of our programs. We may also

disclose information to another person or to another agency in accordance with approved routine uses, which include, but

are not limited to, the following:

1. To enable a third party or an agency to assist us in establishing rights to Social Security benefits and/or coverage;

2. To comply with Federal laws requiring the release of information from our records (e.g., to the Government

Accountability Office and the Department of Veterans' Affairs);

3. To make determinations for eligibility in similar health and income maintenance programs at the Federal, State, and

local level; and,

4. To facilitate statistical research, audit, or investigative activities necessary to assure the

integrity and improvement of Social Security programs.

We may also use the information you provide in computer matching programs. Matching programs compare our records

with records kept by other Federal, State, or local government agencies. We use the information from these programs to

establish or verify a person's eligibility for federally-funded or administered benefit programs and for repayment or

incorrect payments or delinquent debts under these programs.

A complete list of routine uses for this information is available in our Privacy Act Systems of Records Notices, 60-0089,

Claims Folders Systems. This notice and additional information regarding our programs and systems are available online

at www.socialsecurity.gov

or at your local Social Security office.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. §3507, as

amended by Section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we

display a valid Office of Management and Budget control number. We estimate that it will take about 15 minutes to read

the instructions, gather the facts, and answer the questions. SEND THE COMPLETED FORM TO YOUR LOCAL

SOCIAL SECURITY OFFICE. The office is listed under U. S. Government agencies in your telephone directory or

you may call Social Security at 1-800-772-1213 (TTY 1-800-325-0778). You may send comments on our time estimate

above to: SSA, 6401 Security Boulevard, Baltimore, MD 21235-6401. Send only comments relating to our time

estimate to this address, not the completed form.

Form SSA-795 (09-2015) ef (09-2015)

gillisonnevency99.blogspot.com

Source: https://handypdf.com/pdf/form-ssa-795